Everyday Economics may receive compensation for purchases made though links on our website.

Staying on top of all of your credit score is important, especially if you’re planning on making a major purchase in the near future. What’s even more important is monitoring your credit to make sure you’re alerted immediately if your identity is stolen.

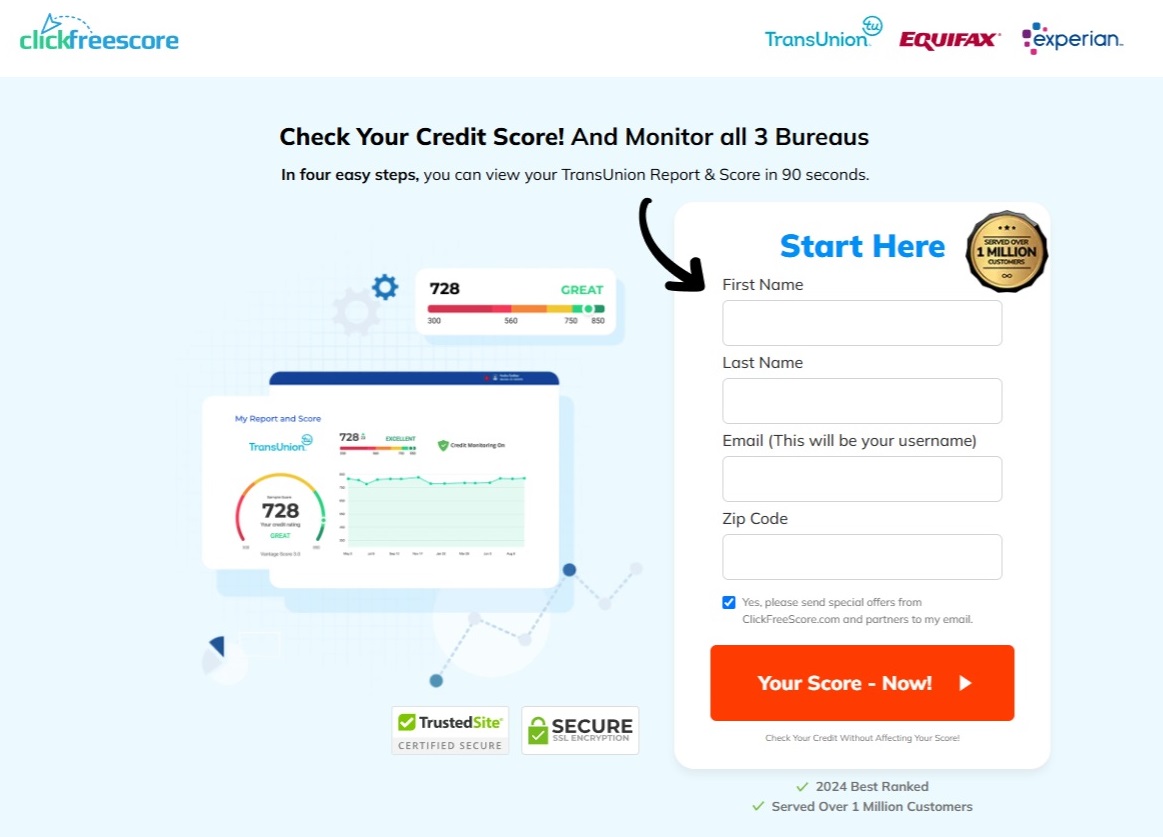

ClickFreeScore has a pretty easy to use website with a dashboard that shows your credit score and monitors your credit for you. It takes about 5 minutes to go from start to finish on it. Here’s a step by step guide to signing up and using the site: (Note: The site may look slightly different on mobile, these screenshots are from the desktop site)

Click on the “Your Score – Now!” button which will take you to the next page where you start to verify your identity:

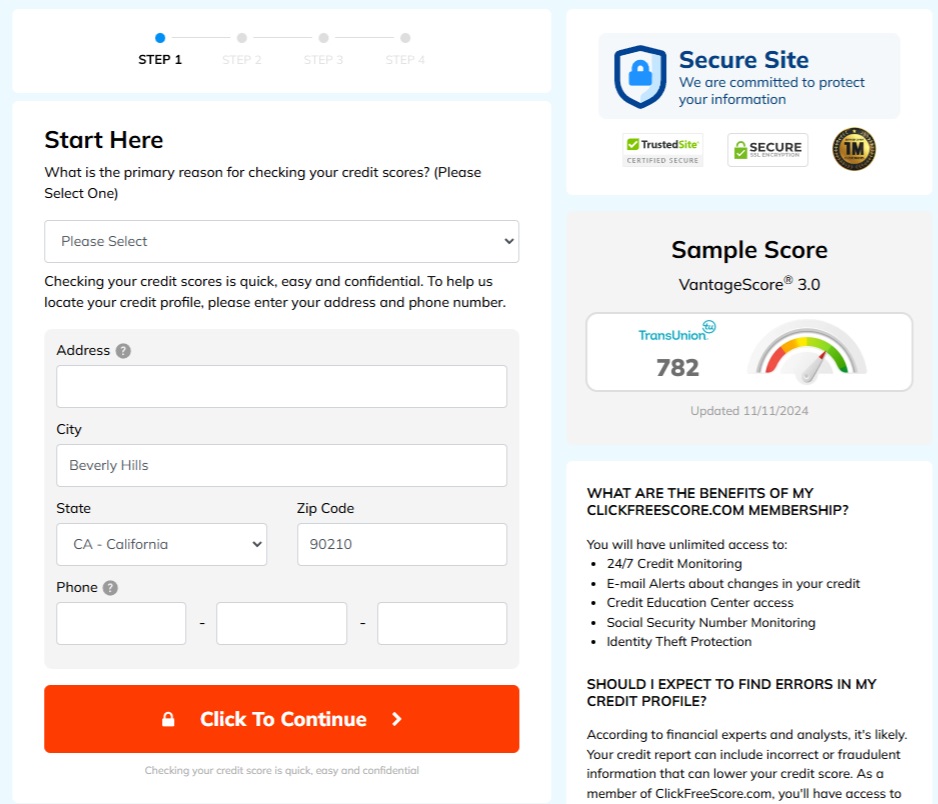

From here, you’re going to enter your basic information – name/address/phone number – which is what you’d need to enter on any website dealing with your personal information. Clicking “Click to Continue” takes you here:

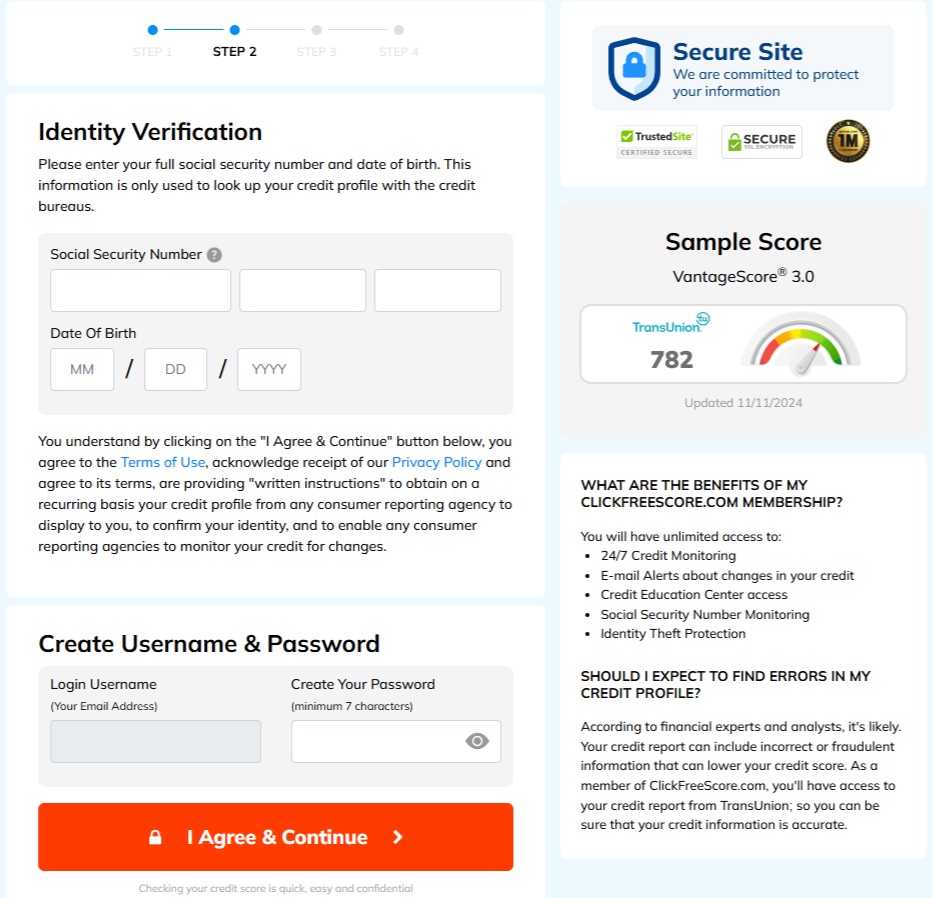

Just like any form you’ve ever filled out (loan application/checking your credit score/etc.) where your credit is pulled, you’ll need to enter your Social Security number and your date of birth. You’ll also enter your email for your username and make a password for your ClickFreeScore account. Once you’ve done that, you’ll hit “I Agree & Continue” which will take you to this page:

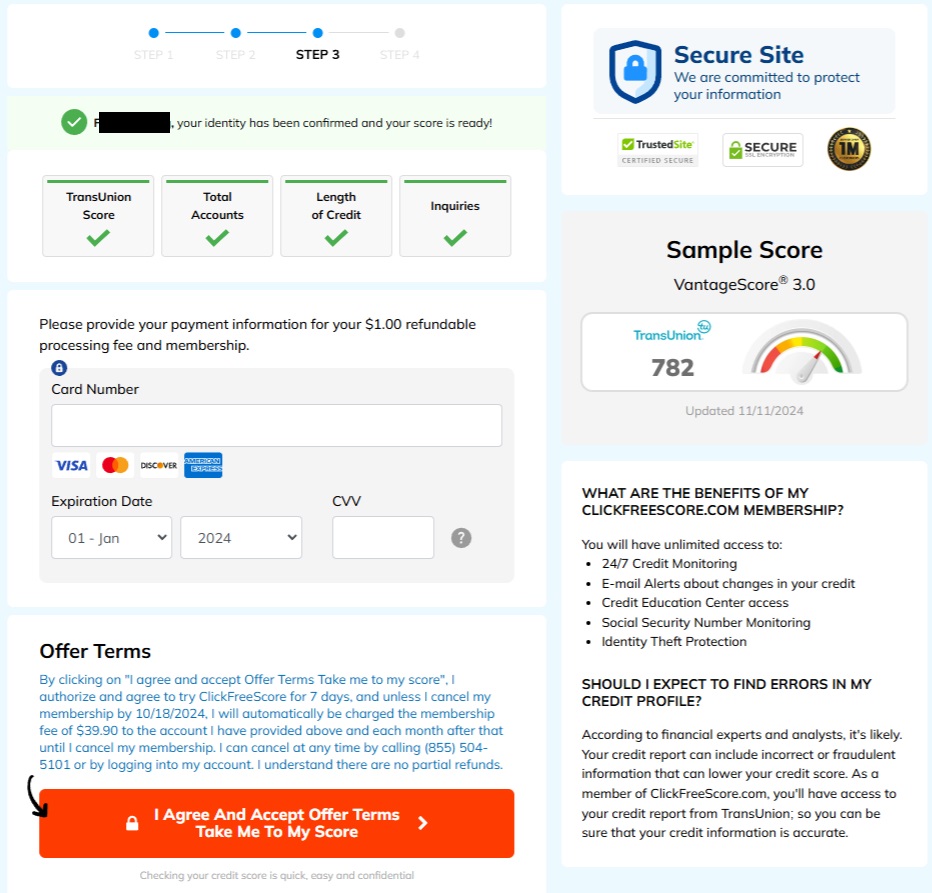

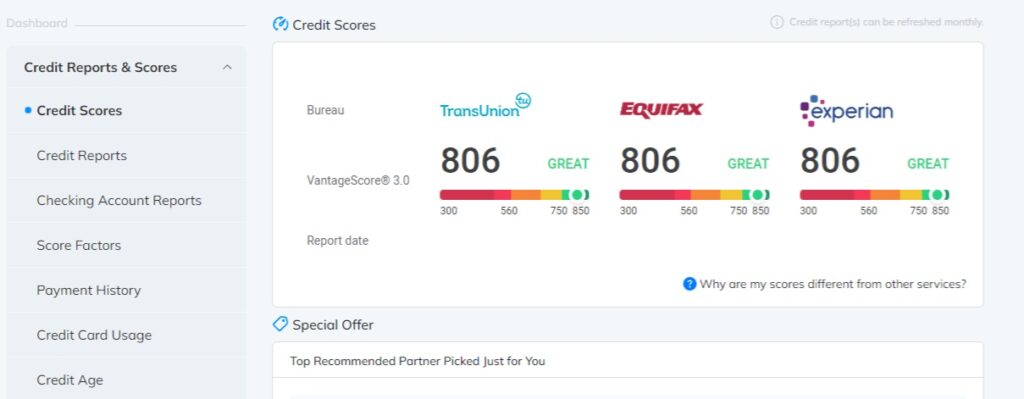

The verification went through pretty quickly. Here, you’ll put in your credit card information. Take a look at the offer terms, it’s $1 for the 7 day trial, if you want to continue seeing your score and keep the credit monitoring after that, it’s $39.90/month. If you want to cancel, they give you the option to do it from your account, or by giving them a call. Once everything is confirmed, you’ll get taken to your dashboard here:

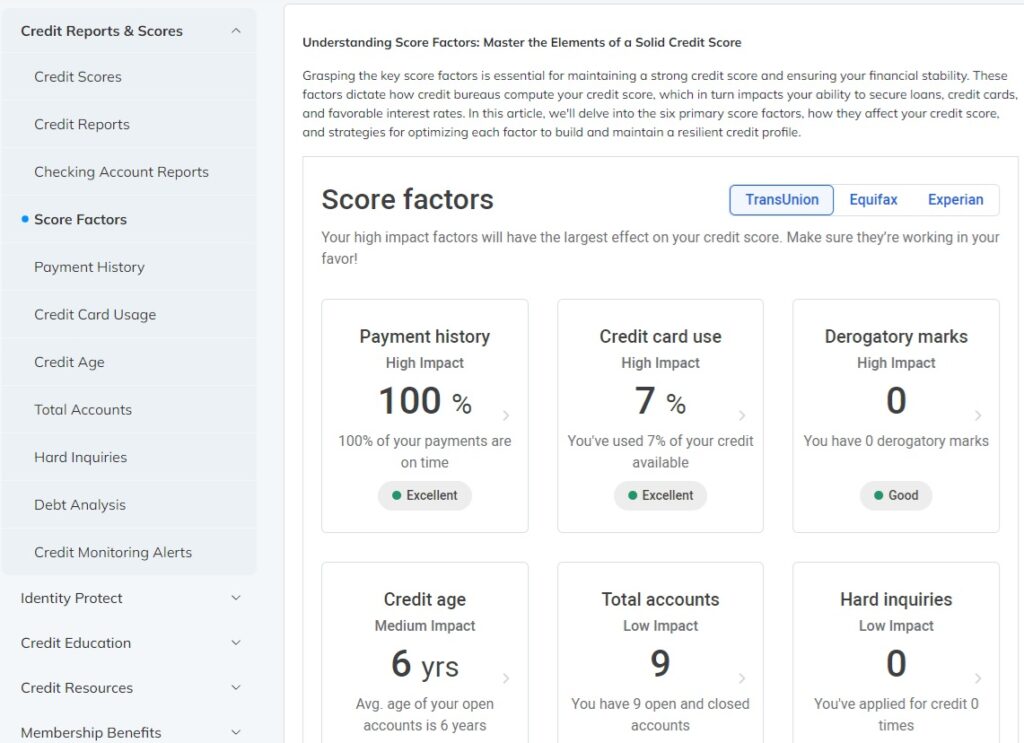

On the left side, you’ll get a full view of everything involving your credit. You can see your score factors, payment history, credit usage, etc. There isn’t a lot of variation in my credit scores and the reports themselves are updated every month. As you can see, you’ll get information from regarding every segment of your credit:

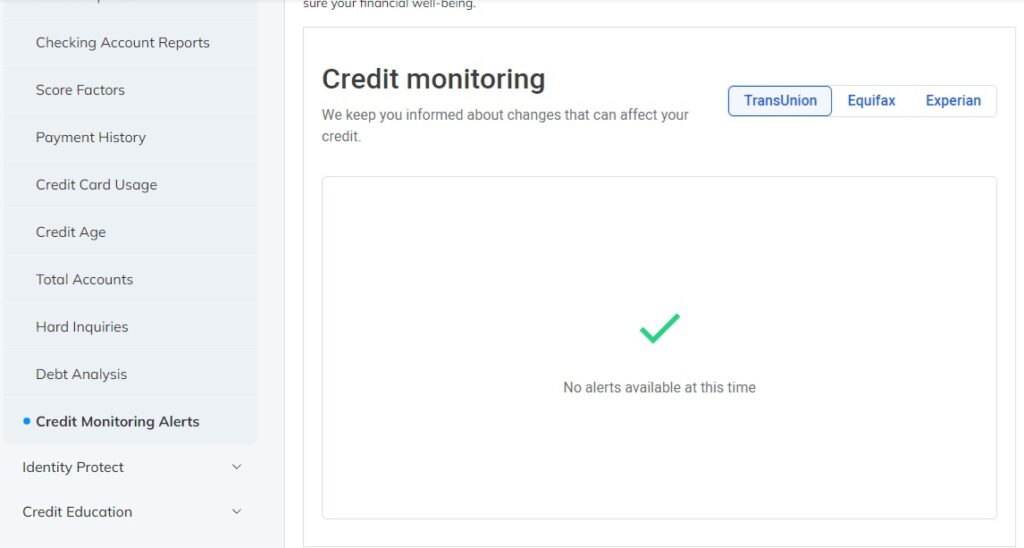

My credit profile is pretty straightforward. The average account age takes into consideration every open account you have. For me, a home loan, new credit card and car loan in the last 5 years counter balances my older credit cards. Perhaps most important of all is the credit monitoring alerts:

Thankfully, everything appears to be good on my end. They will alert you though if a new account appears, letting you limit any damage before it’s done.

ClickFreeScore offers a solid monitoring service and lets you see your credit score easily. You can try their credit monitoring service for $1 and if you don’t like it, they make it pretty easy to cancel. Give it a shot and see for yourself.